A signal rule is a collection of conditions or comparisons. You can compare any of the following:

Indicators, and their specific values

Symbols - you can compare Ask or Bid of one symbol against any other value, including other symbols.

Values - you can add specific values or amount, for example, a pivot point value.

Bars - Tradeworks allows you to compare bar values with any other available values list above.

Please follow the guide below for more details.

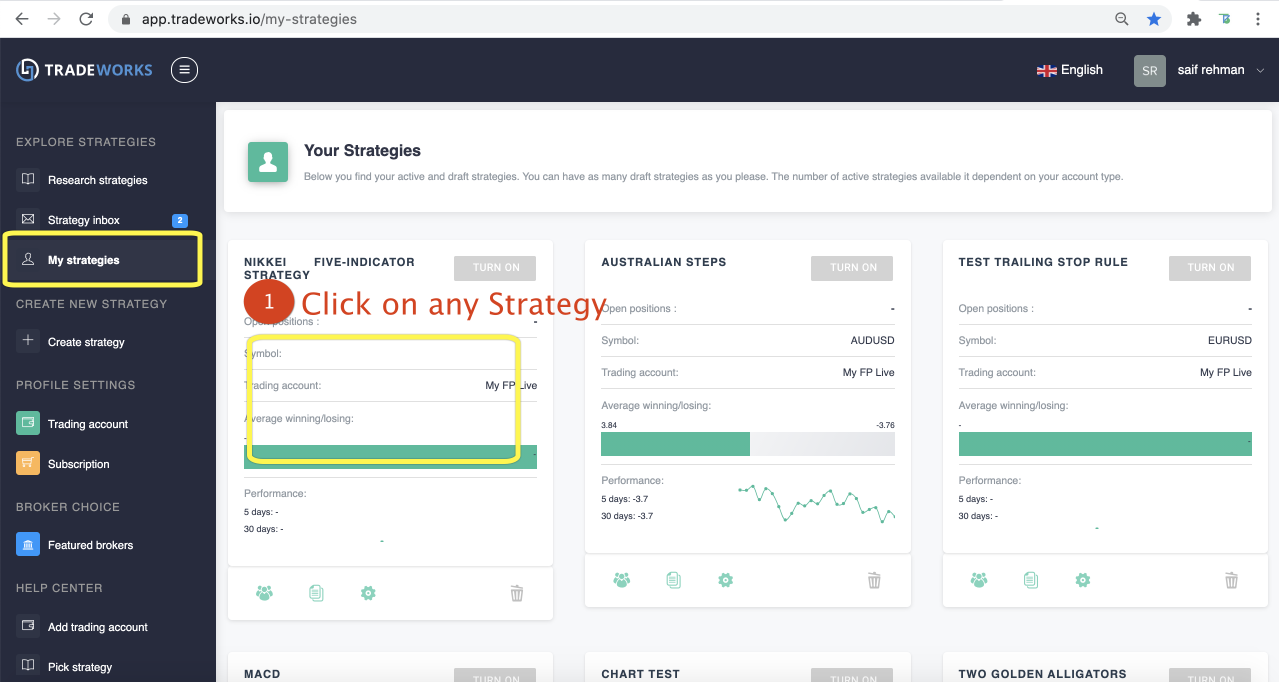

Click on "My strategies" and pick any trading robot strategy.

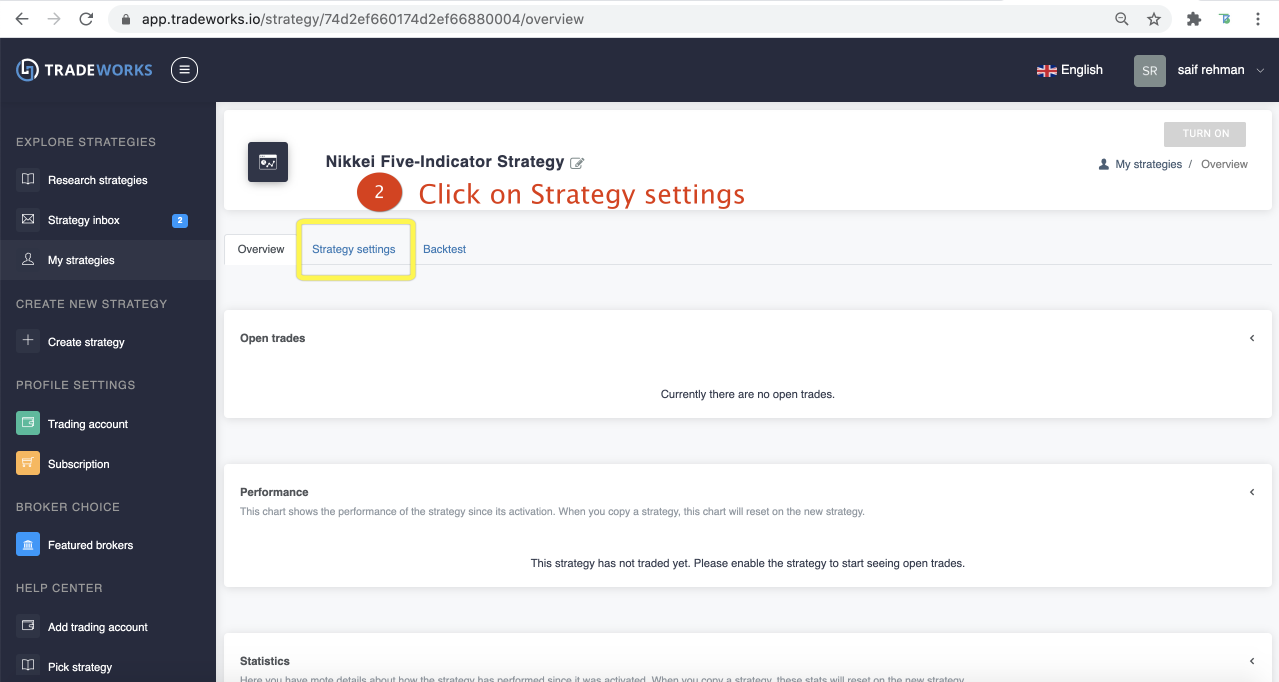

Click the "Strategy Settings" tab.

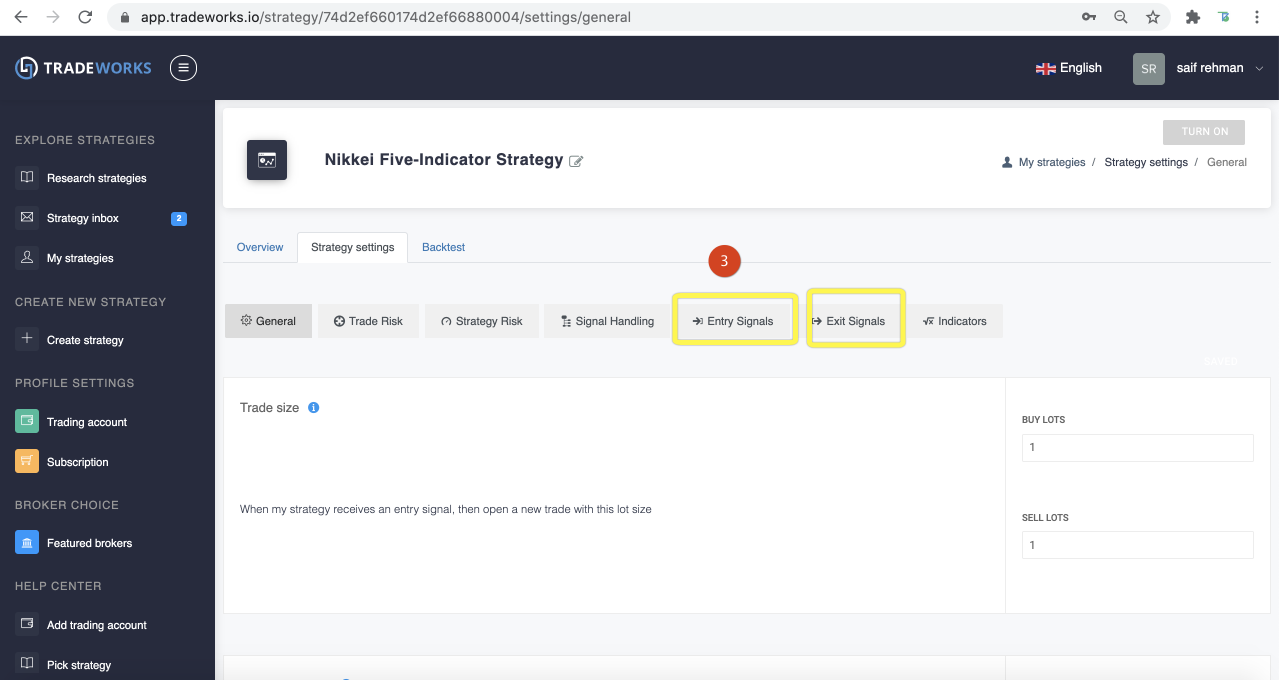

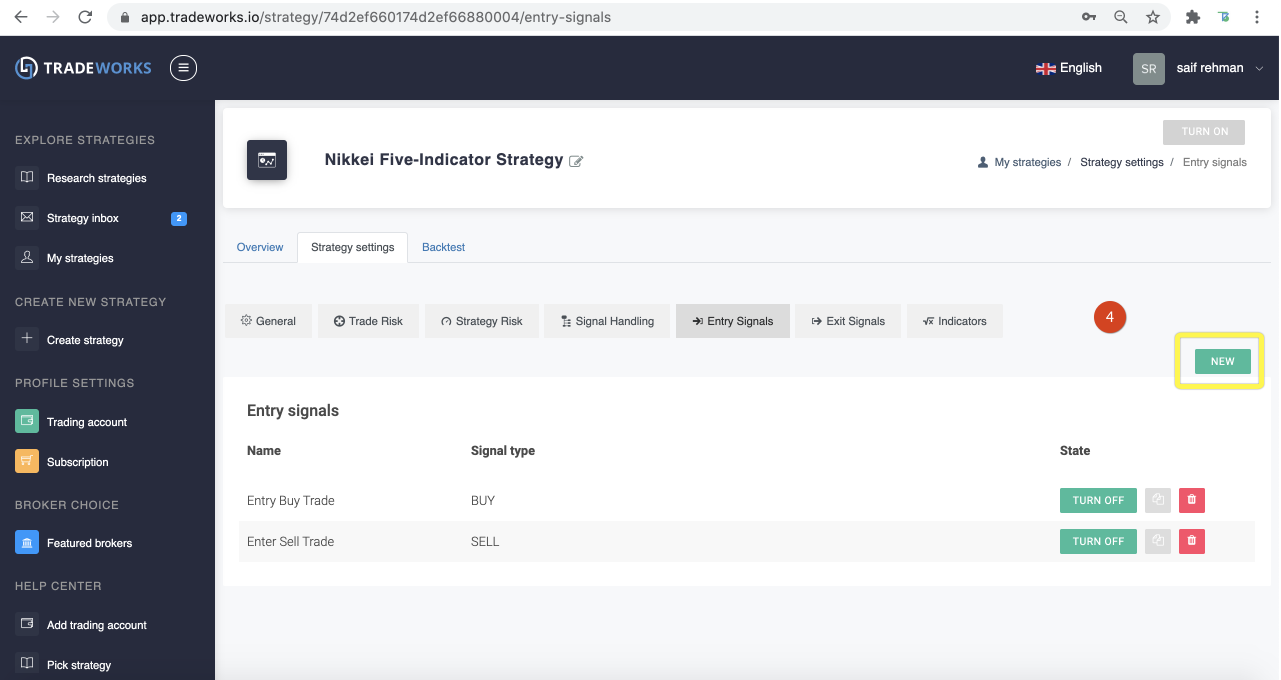

To create a signal for opening positions, use "Entry Signals". To generate a signal to close positions, use "Exit Signals."

Click "NEW" to create a new signal.

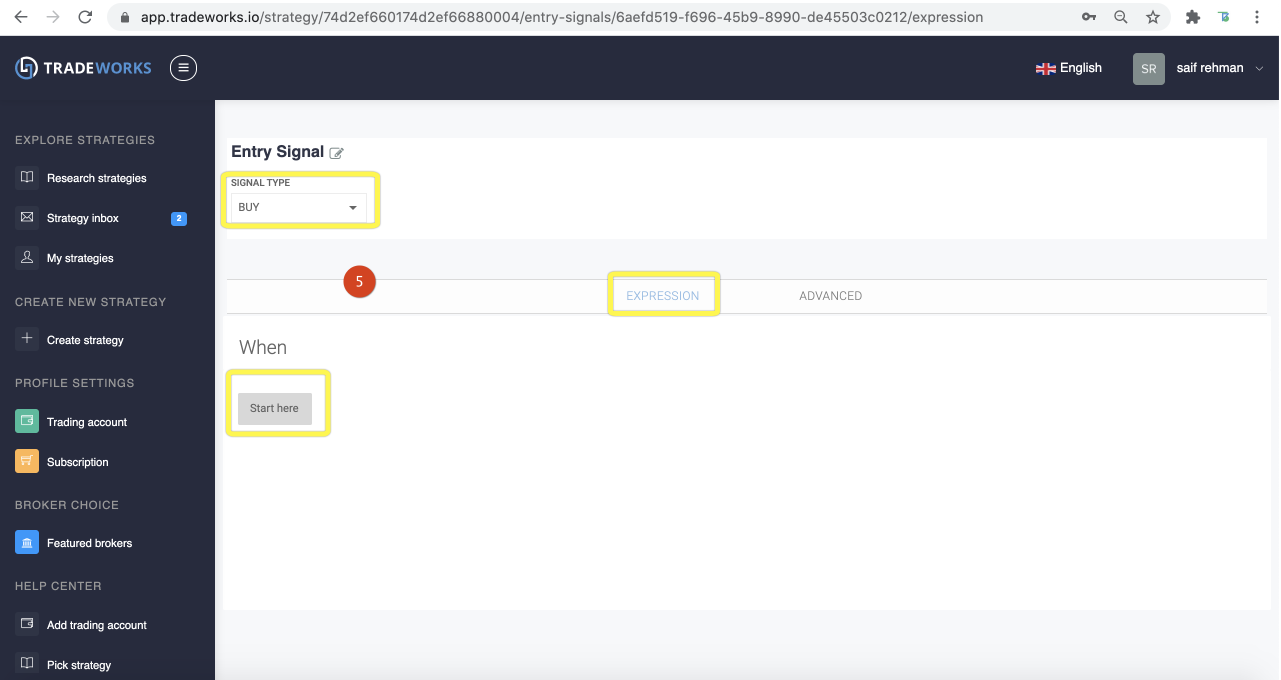

Under "Entry Sigal", in the "SIGNAL TYPE" dropdown, you can choose "BUY" to create a signal to create a long position and "SELL" to create a signal to open a short position.

Logic, sometimes referred to as operator, is the type of comparison. Tradeworks includes the following:

Greater than / Less than

Greater than or equal / Less than or equal

Equals / not equal

Crosses rules - this is comparing how a value changes over time, in relation to another value. This is a powerful feature that is useful for writing rules like “when the moving average crosses from above to below the EURUSD Ask”.

Crosses from above to below and Crosses from below to above.

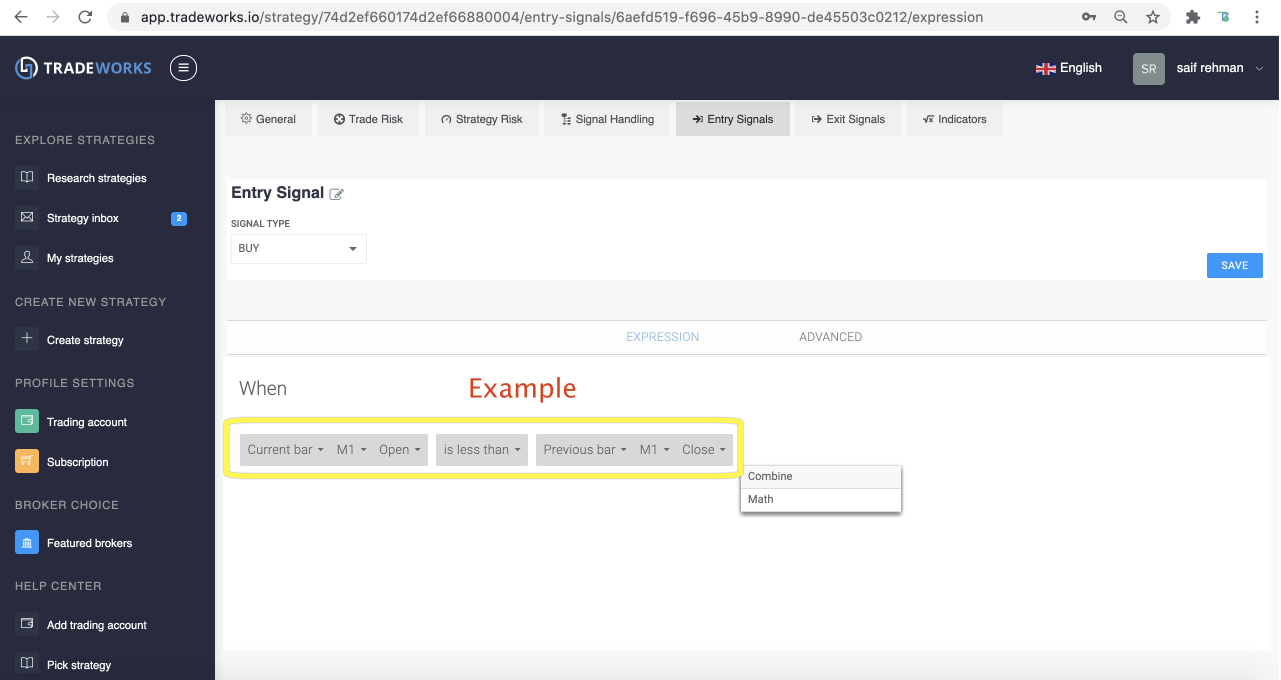

Here is an example:

In Tradeworks, you can build signals using four join operators

And - this joins one rule condition to another. Rules that have And are less likely to activate they have more conditions that need to be met before they can be considered true.

Or - this is an alternate condition.

Before - current condition comes before the following condition

After - current condition comes after the following condition

A simple example of the use of the "AND" join operator that creates a signal when three one-hour bar high values are trending upwards:

Here is an example of a signal that includes the use of the Bollinger Band indicator:

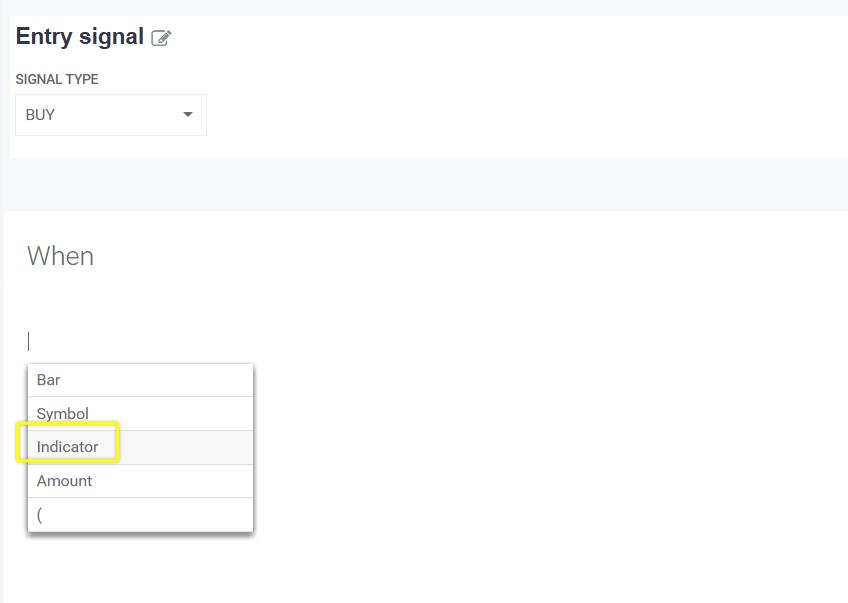

To write a rule that uses an indicator, you will need to have already added at least one indicator to your strategy. If you have one or more indicators added to your strategy, they will show in a drop-down list once you click on the Indicator button on the Rule Editor screen.

You may also choose "Indicator" from the drop-down as shown below.

Once your chosen indicator is selected, you should then set which specific value from the indicator you wish to use in your rule (if applicable).

A signal can have the following advanced settings:

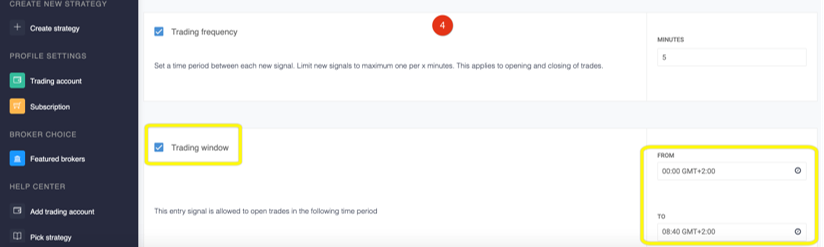

Trading Frequency: Allows you to set a time limit between the first and when it can fire next, regardless of whether the rule condition is true. This can be useful if you want to write a rule that would continue to fire, for example, every 5 minutes when the Bid is above the upper Bollinger Band.

Trading Window: Allows you to set your signal rules to be active during a particular trading session or Time Period.

The settings look like this:

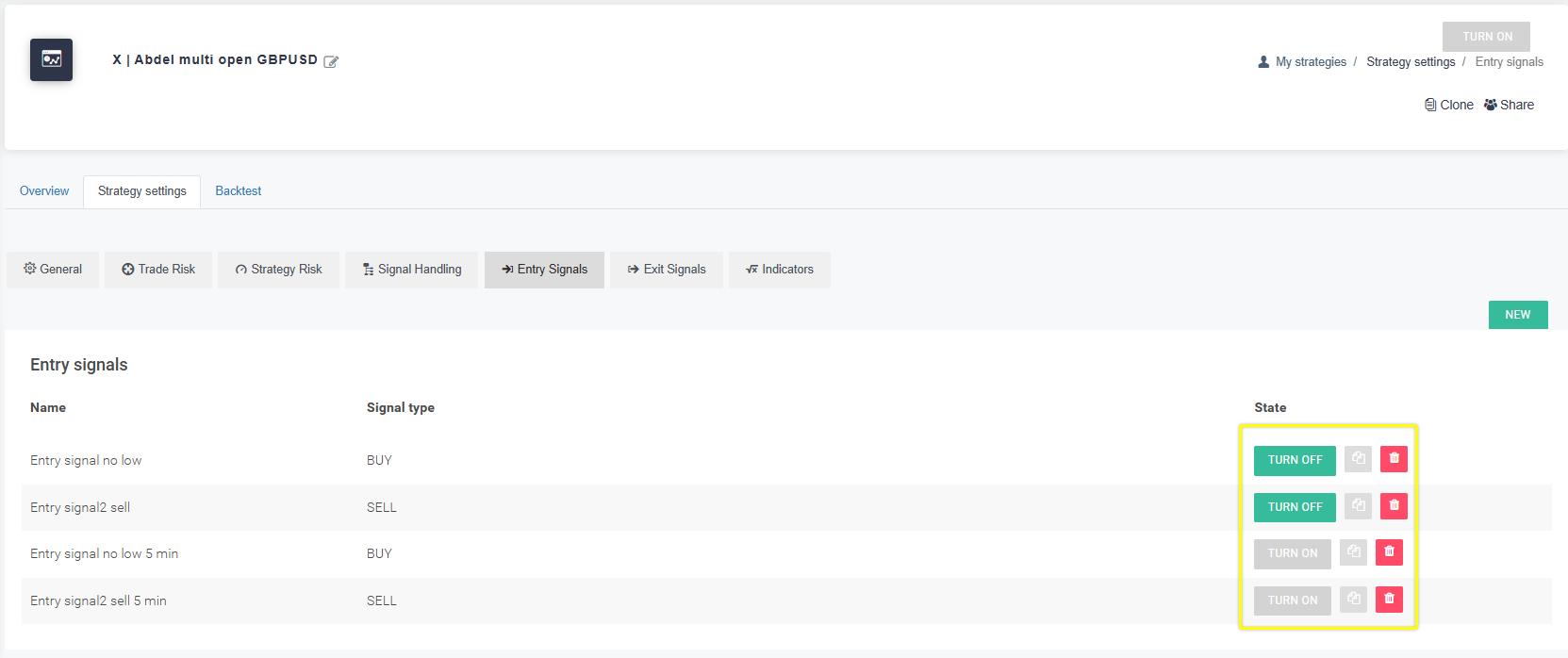

When adding or editing any signal rule, you can:

Duplicate the rule: This is useful if you wish to have a similar rule and change only a few settings. For example, you may have a signal that fires when a fast-moving average closes from below to above a slow-moving average. By duplicating this rule, you can change the operation from below to above to above to below to have an opposite-direction signal.

Enable or Disable the rule: This can be useful if you have a signal rule that you would like to temporarily remove from a strategy. Rather than deleting it, you can disable a rule and then re-enable it at a later stage.

Delete: permanently removes a rule from your strategy.

You find these features in the "State" column: