You can choose between a long list of Money Management capabilities to add to your trading strategy

Please follow the guide below for more details.

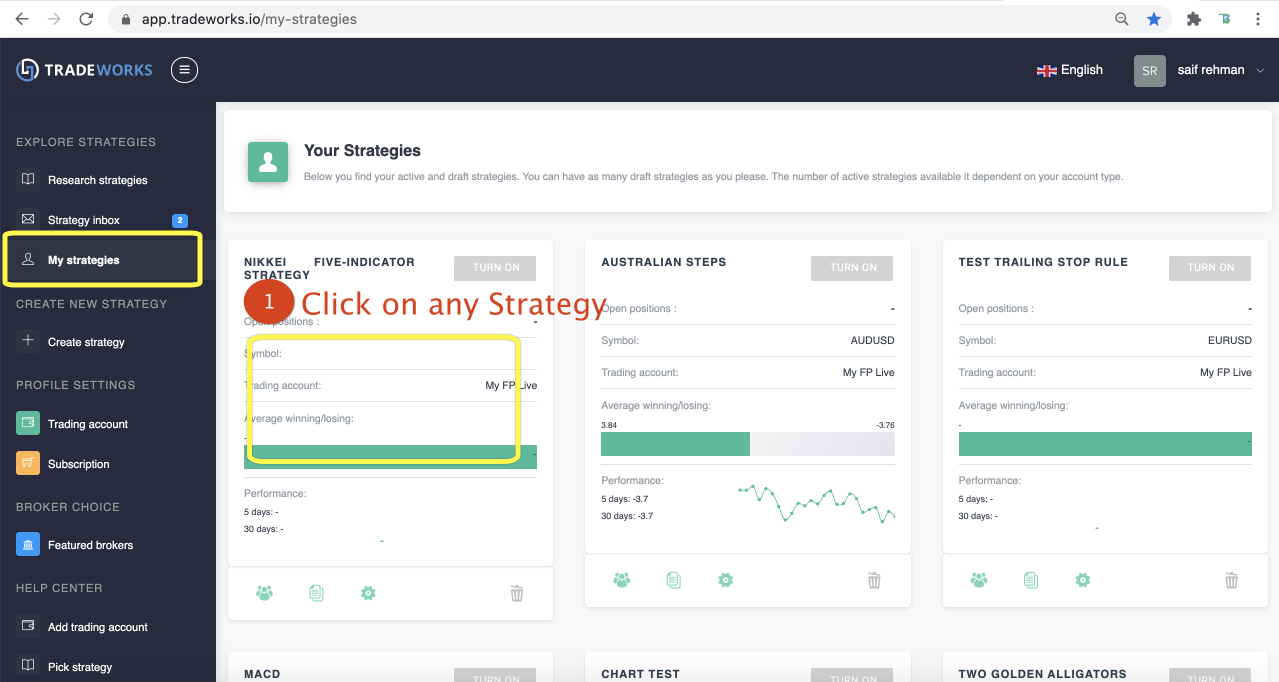

Start by clicking "My strategies".

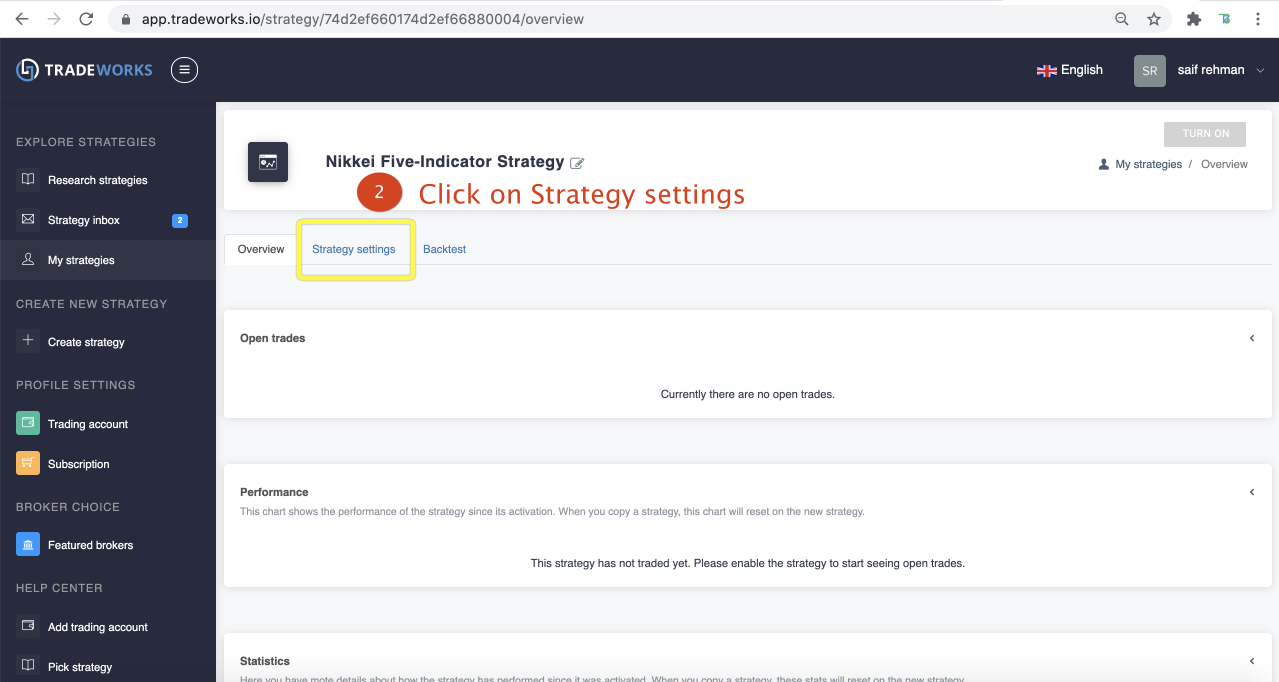

Then go to the "Strategy settings" tab.

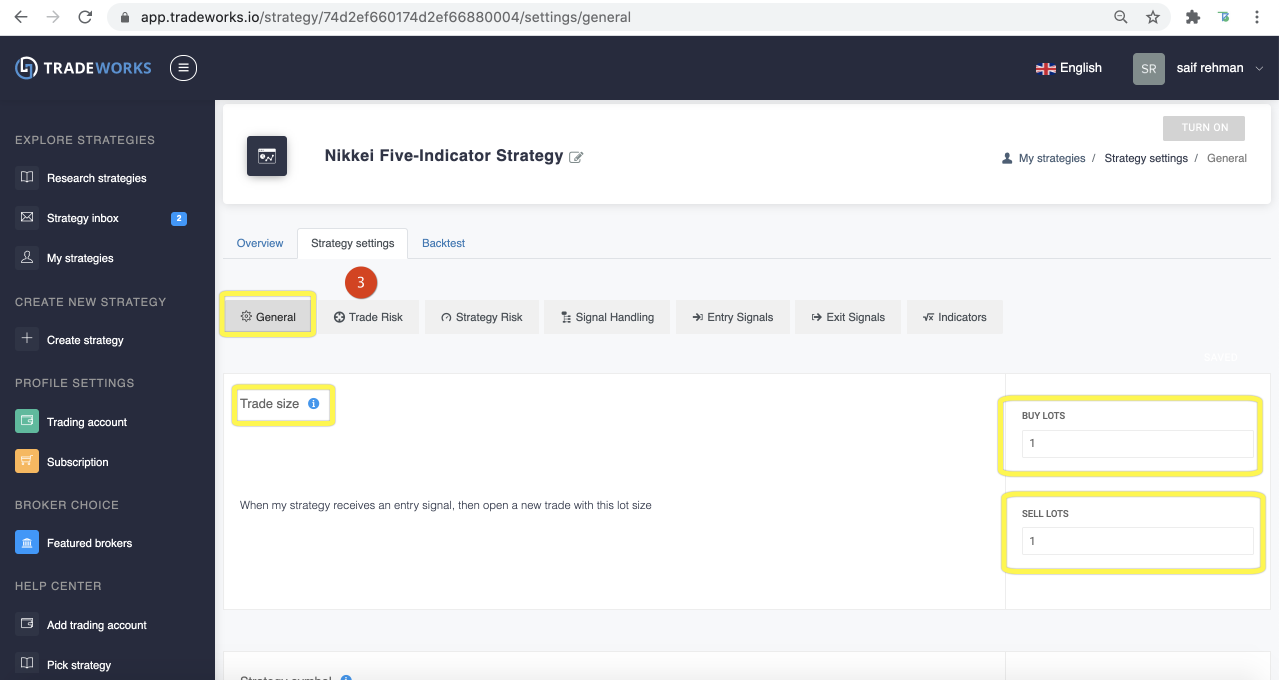

Trade Size

Your strategy is required to specify a trade size.

The amount, in lots, you wish to trade. You can specify a value unique value for trading long (buy) or short (sell).

The lot size you enter here must be compatible with your broker's acceptance, or the strategy will not trade. However, in most cases, this is not a problem.

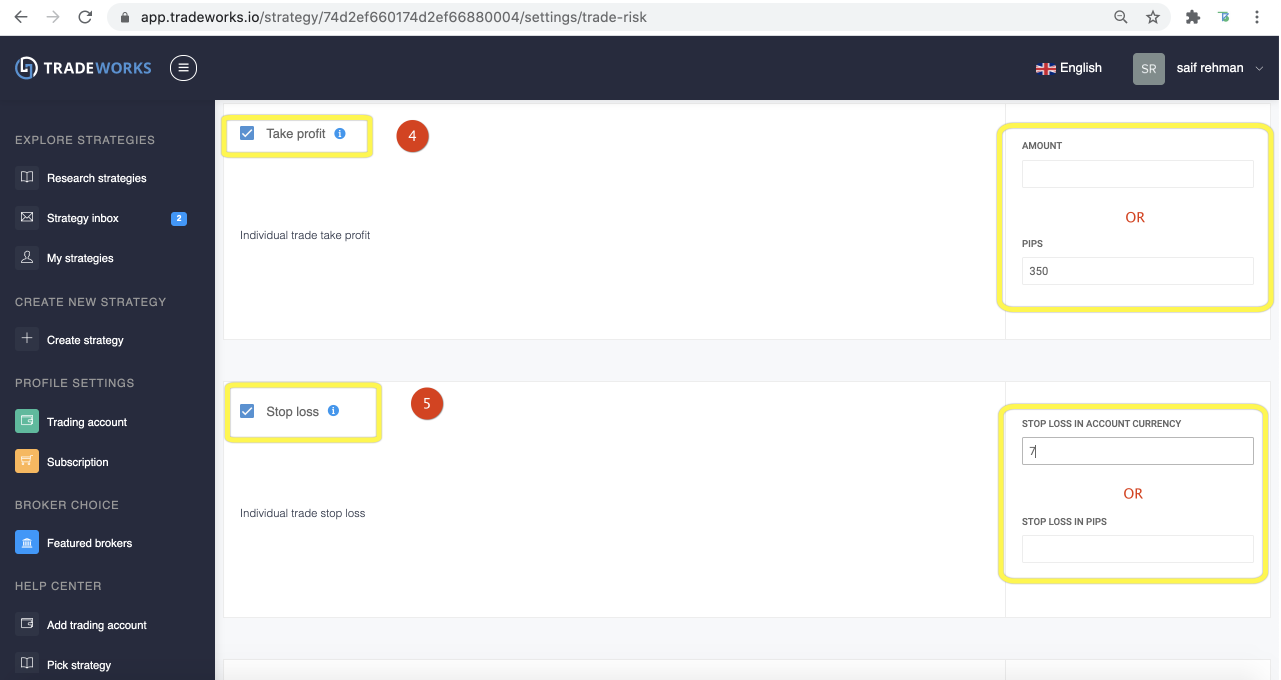

Set your take profit and stop loss targets in amount (of your trading account currency) or in pips.

Whichever comes first will trigger the position to take profit or cut your loss.

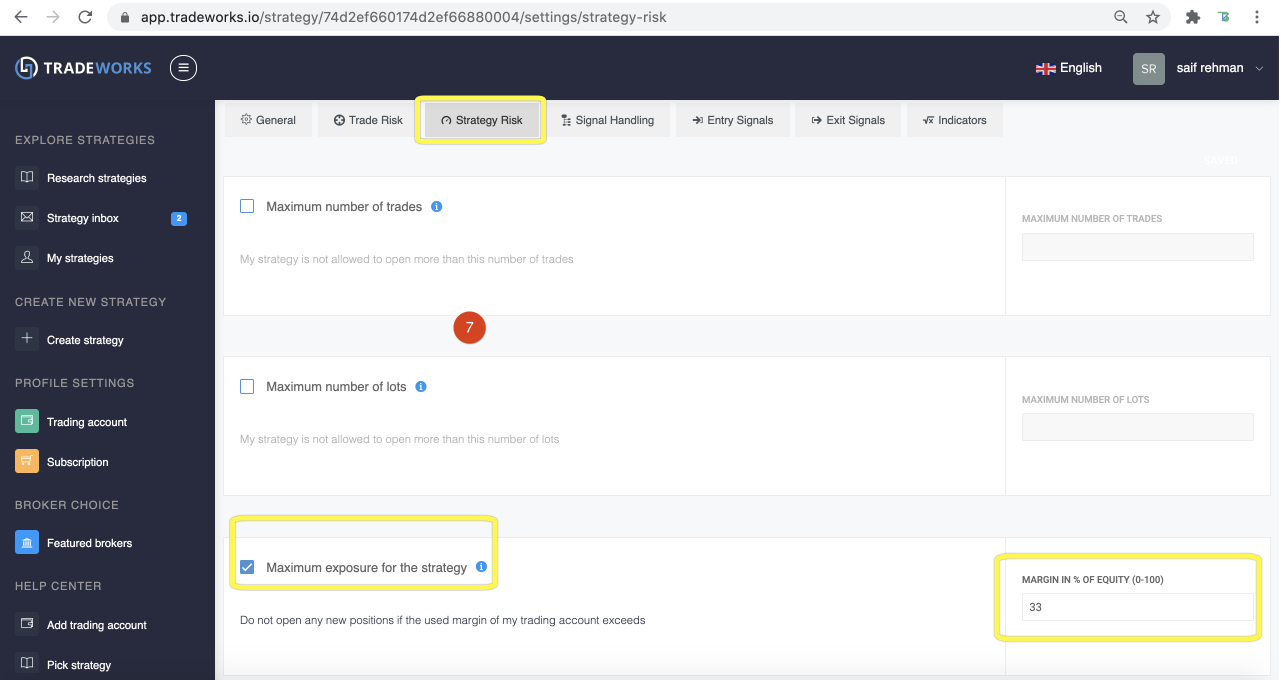

This rule allows you to limit the exposure your strategy will be able to open as measured in % of your account equity used for margin. When you pass the desired threshold, the strategy is unable to open more trades in the same direction, which would result in additional margin requirements. Additionally, you can choose to automatically close either "all", "profitable," or "losing" positions.

The exposure is calculated by dividing your margin amount by your current equity x100. E.g. you have to place USD 100 to have a position open, and you have USD 1000 in equity. Then, your exposure will be 100 / 1000 x 100 = 10%.

Note: while you may be unable to open more positions, the strategy remains 100% operational and will continue monitoring Money Management rules and for opposite-direction trades.

WARNING: When activating the option to close "all" or "losing" positions, please be warned that should just one open position result in the threshold level being breached, the rule will trigger instantly, and the position the strategy just opened will be closed immediately. Exceeding the maximum exposure and thereby triggering the rule of closing all or losing positions could, in fact, be true for longer periods of time, causing the rule to trigger, thereby causing opening and closing positions immediately over and over again. However, this is of course only if the conditions for opening a position (the entry signal) are present.

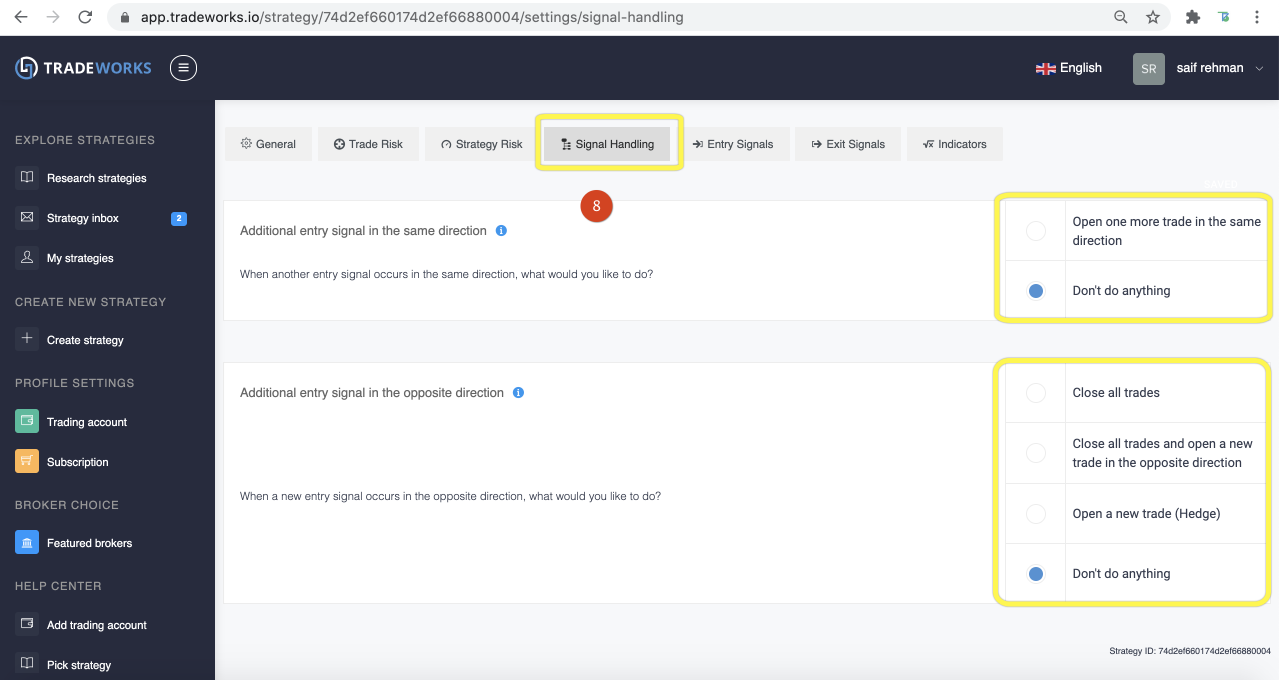

These rules allow you to manage the following:

What do you want to do when your strategy intends to open an additional position?

What do you want to do if that additional position is in the opposite direction? (E.g., you already have a long position open and now the strategy wants to open a short position).